Introduction

Navigating the world of car dealerships can be as complicated as it is rewarding. One key component of running a legitimate car dealership is obtaining a car dealer bond. But what happens if you don’t have one? Many new and even established dealers often overlook this crucial requirement. In this article, we'll explore the implications of not possessing a car dealer bond, its significance in building trust, and how it shapes the dynamics of the automotive business.

What Happens If You Don’t Have a Car Dealer Bond?

A car dealer bond serves as a safety net for consumers and ensures that dealers adhere to state laws and regulations. Without it, several issues may arise:

Legal Repercussions: Operating without a bond is illegal in most states, leading to potential fines or even criminal charges. Loss of License: Your dealership may lose its license to operate, effectively shutting down your business. Consumer Trust Issues: Customers are less likely to purchase from unbonded dealers, fearing fraud or malpractices. Financial Liability: Without a bond, you'll be personally liable for any claims made against you by customers or other businesses.Understanding Car Dealer Bonds

What Is a Car Dealer Bond?

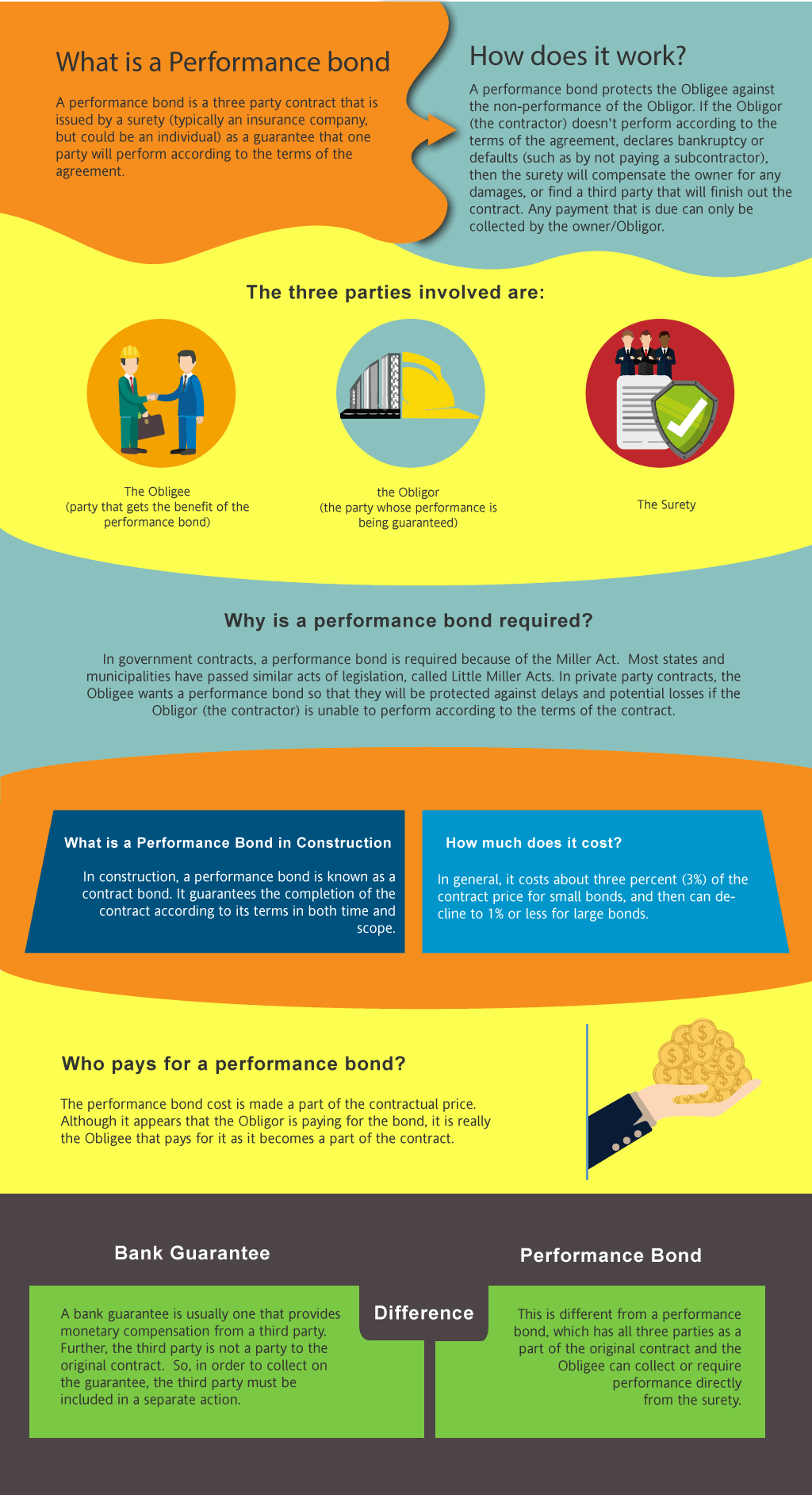

A car dealer bond is essentially an agreement between three parties: the principal (the car dealer), the obligee (the state), and the surety (the bonding company). This bond guarantees that you will comply with all laws governing vehicle sales and provide compensation for any potential damages resulting from non-compliance.

Types of Car Dealer Bonds

There are generally two types of bonds associated with car dealers:

- State Required Bonds: These are mandated by state law before you can obtain your dealer's license. Additional Bonds: Depending on your business model, you might need extra bonds for specific activities like auctioning vehicles or selling used cars.

The Importance of Having a Car Dealer Bond

Consumer Protection

Having a bond protects consumers from fraudulent license and permit bonds practices. It assures them they can file claims against you if you fail to deliver on your promises.

Building Credibility

A bonded dealership exudes professionalism and trustworthiness. It shows potential customers that you're serious about conducting business ethically.

Consequences of Not Having a Car Dealer Bond

Legal Consequences

Operating without a car dealer bond can lead to severe legal ramifications. States often impose hefty fines on unbonded dealers, which could accumulate over time.

Impact on Business Operations

Without a bond, your ability to operate legally becomes compromised. This may lead to operational limitations and impact relationships with suppliers or financial institutions.

How Does Lack of a Car Dealer Bond Affect Sales?

Customer Hesitancy

Customers are naturally wary when purchasing high-value items like cars. The absence of a bond raises red flags about your legitimacy.

Reduced Financing Options

Many financing institutions require proof of bonding before extending credit lines to dealerships. Without this assurance, securing loans becomes much more difficult.

Can You Get Away Without A Car Dealer Bond?

While some might consider it an option, attempting to operate without a car dealer bond is shortsighted at best and reckless at worst. The risks far outweigh any perceived benefits.

Alternatives to Having a Car Dealer Bond

Is There A Way Out?

Unfortunately, there aren’t really any alternatives that fulfill the same legal requirements as having a car dealer bond. However:

- Some states offer lower surety amounts for new dealers. You might find specialized insurance policies that cover specific areas but will not replace the necessity for bonding.

What Are State Regulations Regarding Car Dealer Bonds?

Each state has its own rules governing car dealer bonds. Researching local laws is critical; failure to comply could lead to significant penalties or loss of your dealership license.

How Long Does It Take To Get A Car Dealer Bond?

Typically, securing a car dealer bond can take anywhere from one day to several weeks depending on various factors such as:

- The surety company's requirements Your credit history The amount needed

Steps To Obtain A Car Dealer Bond

Research State Requirements Choose A Reliable Surety Company Complete An Application Provide Necessary Documentation Pay The PremiumCosts Associated With A Car Dealer Bond

The cost varies by state but typically ranges from 1% to 15% of the total bond amount based on your credit score and other factors.

| Item | Cost Range | |------|------------| | Low Credit Score | 10% - 15% | | Good Credit Score | 1% - 5% |

FAQs About Car Dealer Bonds

What exactly does a car dealer bond cover?- It covers financial losses incurred by consumers due to violations committed by the dealership.

- Yes, each state has unique requirements regarding bonding.

- While challenging, it's possible; many sureties specialize in high-risk applicants.

- Typically one year but must be renewed annually.

- Consult your surety company immediately; they may review terms based on your situation.

- No; most states require bonds specifically due to their protective nature.

Conclusion

In conclusion, understanding what happens if you don’t have a car dealer bond is crucial for anyone entering the automotive sales industry—whether you're starting fresh or looking to expand an existing operation! Legal consequences are just the cost of license and permit bonds tip of the iceberg; consumer trust takes years to build but can be lost overnight without proper bonding in place!

If you're serious about establishing credibility while protecting both yourself and your customers, prioritizing this requirement is non-negotiable! So don’t wait—get informed today!